By: Tadia Toussaint

The retail sales rate continued to rise steadily in January, despite a weakened stock market and slowing global growth.

With January retail sales stronger than economists expected, consumers spent $449.9 billion mostly on services and experiences and online shopping.

This month’s 0.2% increase in retail sales ties with December’s seasonally adjusted rate after revisions corrected the previously reported decline of 0.1%. The three-month steady increase shows that consumers remain optimistic and maintain momentum in spending. The revision for December’s sales also extinguishes the tensions regarding a shrinking economy.

| Paul Turek, labor economist for the Employment Security Department in Washington State thinks that this month’s steady increase in retail sales shows that economy is holding up despite the caution with consumer spending, the low energy and commodity prices and the strong dollar that limits exports. | ||

| “We continue to see job creations, income-getting despite the headwinds that face the economy,” he said. |

The improving wage growth and disposable income generated from the falling gas prices isn’t enough to budge the cautious approach that consumers are taking too much but nonetheless consumer sentiment is gradually rising.

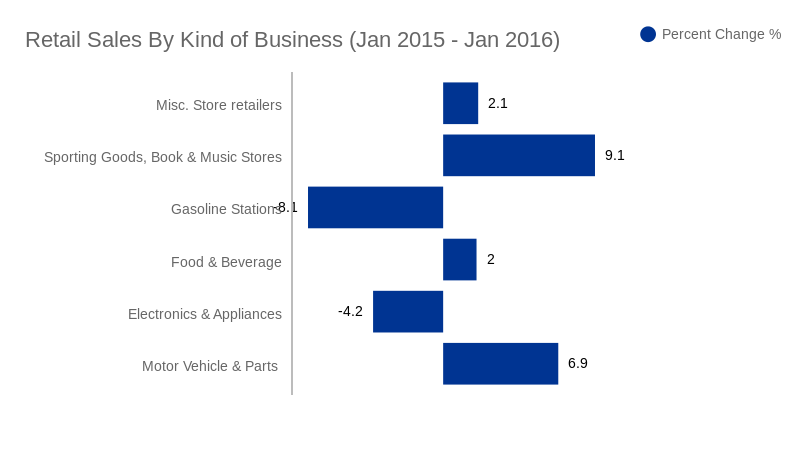

Motor Vehicle and parts dealers increase 0.6% following last month’s 0.5%, its biggest catalyst being low gas prices at a current national average $1.80/ gallon, 64 cents cheaper than last year according to AAA Daily Fuel Gauge Report.

Alex Kogurt, finance manager at Nissan of Queens said that the low gas prices are one less obstacle for the customer to be concerned with when buying a car. The report showed a 3.2 % increase in total sales estimates for motor vehicle and parts dealers over the course of the last year.

“January was a good month for us at Queens Nissan,” he said, with a total of 300 new/used cars in sold January, averaging 10 cars a day.

Consumers drive the economy, making up 70% of total output, so their continued disinterest in spending recklessly is something the some economists are concerned about. Though reported retail sales are showing solid growth to economists the bigger picture painted with this steady growth is that consumers are still feeling apprehensive about spending their money.

This cautiousness that consumers have adopted, for Vanessa Bouchereau-Vincent, a financial advisor at Massachusetts Mutual Financial Group is as a result of the financial market not starting well.

Consumers are showing signs of optimism but carefully. With an influx of 10,000 retirees each day and their savings in the stock market, people are still saving their money, showing that they don’t entirely trust the direction of the economy.

“That memory of 2008 is still there,” she said.

Consumers are looking to leisure goods and services to take their minds off of the non-appealing economy with a 9.1% increase spent in sporting goods, music and book stores from January 2015.